Common Questions When Comparing Pushback and Selective Rack For Your High Density Storage

When warehouse space runs tight, managers are faced with a critical decision: invest in higher-density racking systems or outsource overflow pallets to a third-party facility. Each option carries different costs, risks, and long-term implications.

This article was developed to help operations teams, warehouse managers, and supply chain leaders make sense of those trade-offs. By looking at a real-world case study comparing five-deep pushback racking against selective rack with overflow storage, we can see how the numbers stack up — and, more importantly, what questions you should be asking when evaluating your own facility.

The goal isn’t to prescribe one solution for every operation, but to highlight the factors that drive ROI, efficiency, and control. Below, we’ve outlined the common questions that arise in these scenarios, paired with data-driven answers to help guide informed decision-making.

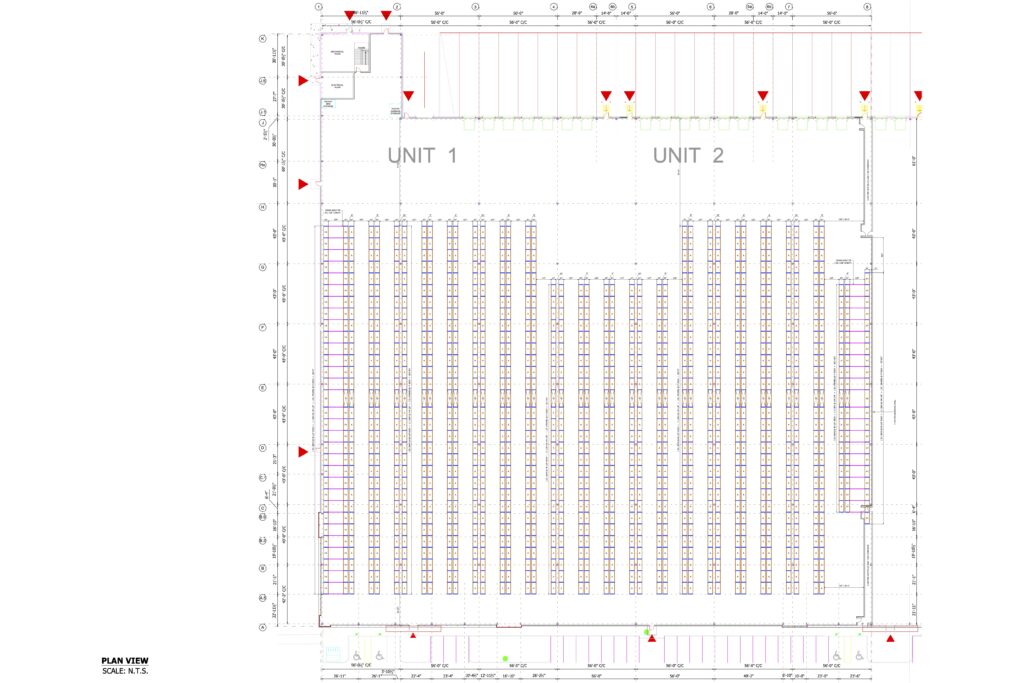

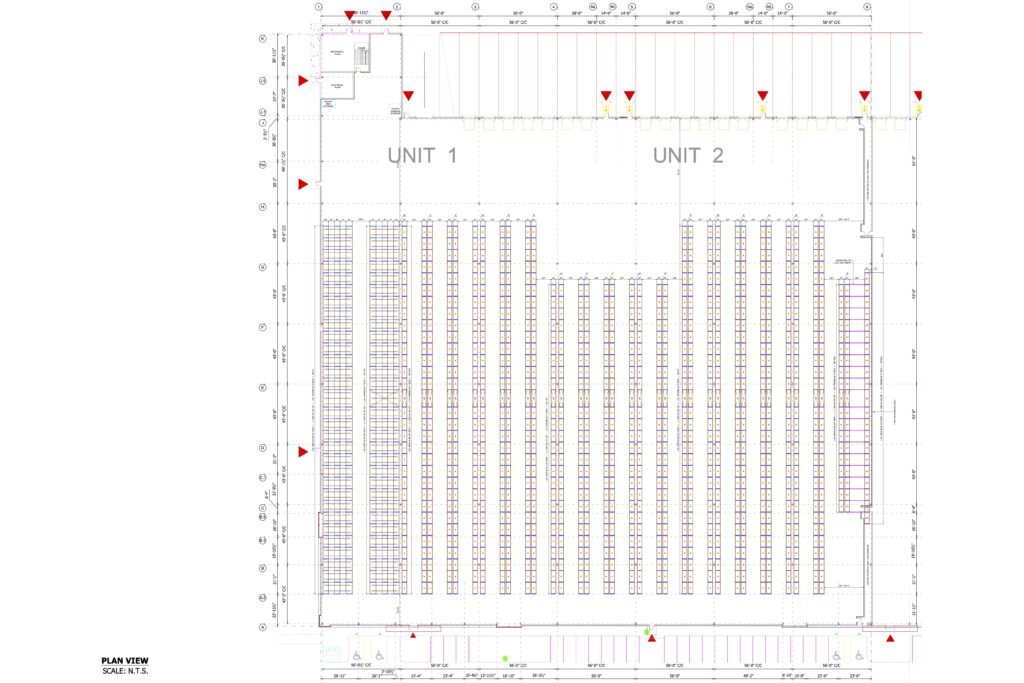

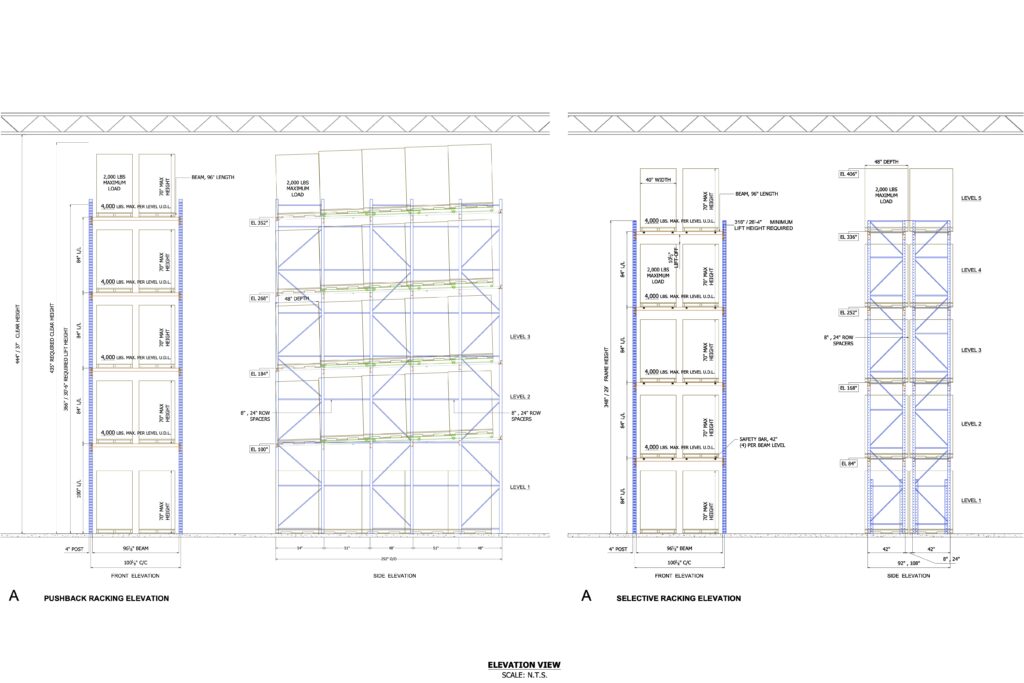

The CAD drawings illustrate two different approaches within the same warehouse footprint. In the first image, in the first building bay, the existing selective racking layout provides 1,860 pallet positions. In the second image, a retrofit to five-deep pushback racking transforms that same area into 3,120 pallet positions — a 68% increase in storage density without expanding the building envelope.

The retrofit entailed:

- Installing 498 pushback lanes, each five pallets deep.

- Converting the structure to support 3,120 pallet positions at an estimated $100 per pallet position, plus installation and freight.

- A total investment of $860,250 covering racking, lanes, installation, and shipping.

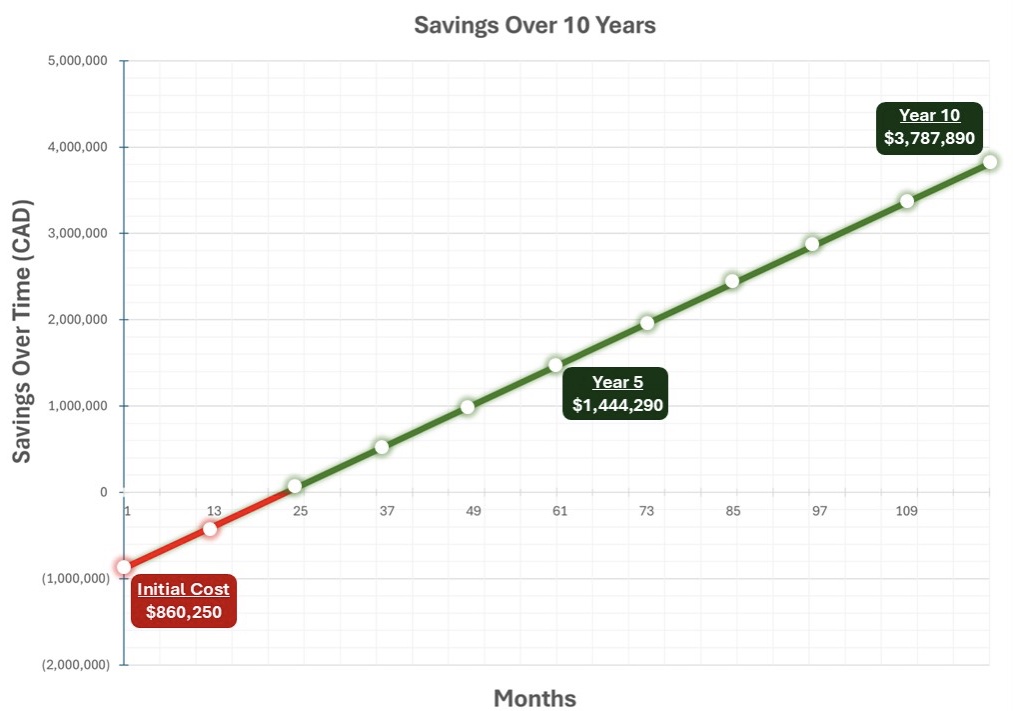

By comparison, if the facility had left its selective rack in place and sent the 1,260 overflow pallets to a third-party warehouse, it would have incurred $468,720 per year in storage, in-fees, and out-fees — not including extra freight or control costs.

This side-by-side scenario highlights the core question: is it better to spend upfront capital on higher-density racking, or accept recurring costs from outsourcing?

Common Questions When Comparing Pushback and Selective Rack

Q: How many more pallets can pushback rack hold compared to selective?

A: In the retrofit example, switching from selective to five-deep pushback increased capacity from 1,860 pallet positions to 3,120 pallet positions — a 68% increase in the same footprint.

Q: What does pushback racking cost compared to outsourcing?

A: The total retrofit cost, including racking, pushback lanes, installation, and freight, was $860,250. By contrast, outsourcing the additional 1,260 pallets to a 3rd-party facility would cost about $468,720 per year (or $39,060/month) in storage and handling fees.

Q: How long is the payback period for pushback?

A: Less than two years. The payback period works out to about 22 months, after which the system delivers ongoing savings while eliminating the need for external warehousing.

Q: Is pushback only worth it for high-volume SKUs?

A: Yes, SKU profile matters. Pushback is most effective when you carry five or more pallets per SKU. The deeper the lanes, the more cost-effective it becomes for medium- to high-volume items. For low-volume SKUs (1–5 pallets), selective rack still makes sense.

Q: What are the operational trade-offs between pushback and selective?

A: Selective rack: Maximum SKU selectivity, but low density. Best for broad SKU ranges with few pallets each.

Pushback rack: Higher density, reduced travel time, and improved cube utilization. Ideal for medium- to high-turnover SKUs where LIFO is acceptable.

Thanks to 3D’s cart design and rail slope, pallets return smoothly to the aisle, minimizing hang-ups and operator delays.

Q: Are there risks with continuing to rely on third-party storage?

A: Outsourcing creates ongoing exposure to:

• Cost volatility (storage, in-fees, out-fees, freight).

• Less control over inventory and access.

• Additional logistics complexity that can slow response time.

Keeping everything in-house with pushback improves control, reduces touchpoints, and removes recurring external fees.

Q: How does this investment future-proof the facility?

A: By increasing capacity by 68% in the same building, the operation avoids expensive expansion or land acquisition. Over the long term, pushback ensures that growth can be absorbed within the existing facility footprint.

Bottom Line

For facilities struggling with space constraints, pushback racking delivers a strong business case: higher density, faster payback, and greater control. In this case, the investment paid for itself in under two years while creating the capacity to meet demand without outsourcing.

Selective rack remains a valuable option for SKU-heavy, low-volume inventories. But when pallet counts rise, pushback is the clear winner in both cost and efficiency.

Every warehouse has unique SKU profiles, space pressures, and operational demands. The right choice between selective and pushback racking depends on aligning storage strategy with those realities.

If you’d like to explore how pushback or selective racking could impact your operation, the 3D Storage Systems team can provide a detailed layout review and ROI analysis tailored to your facility. We’re just a contact form or a phone call away!